Client: International banking group.

Año: 2024 – present.

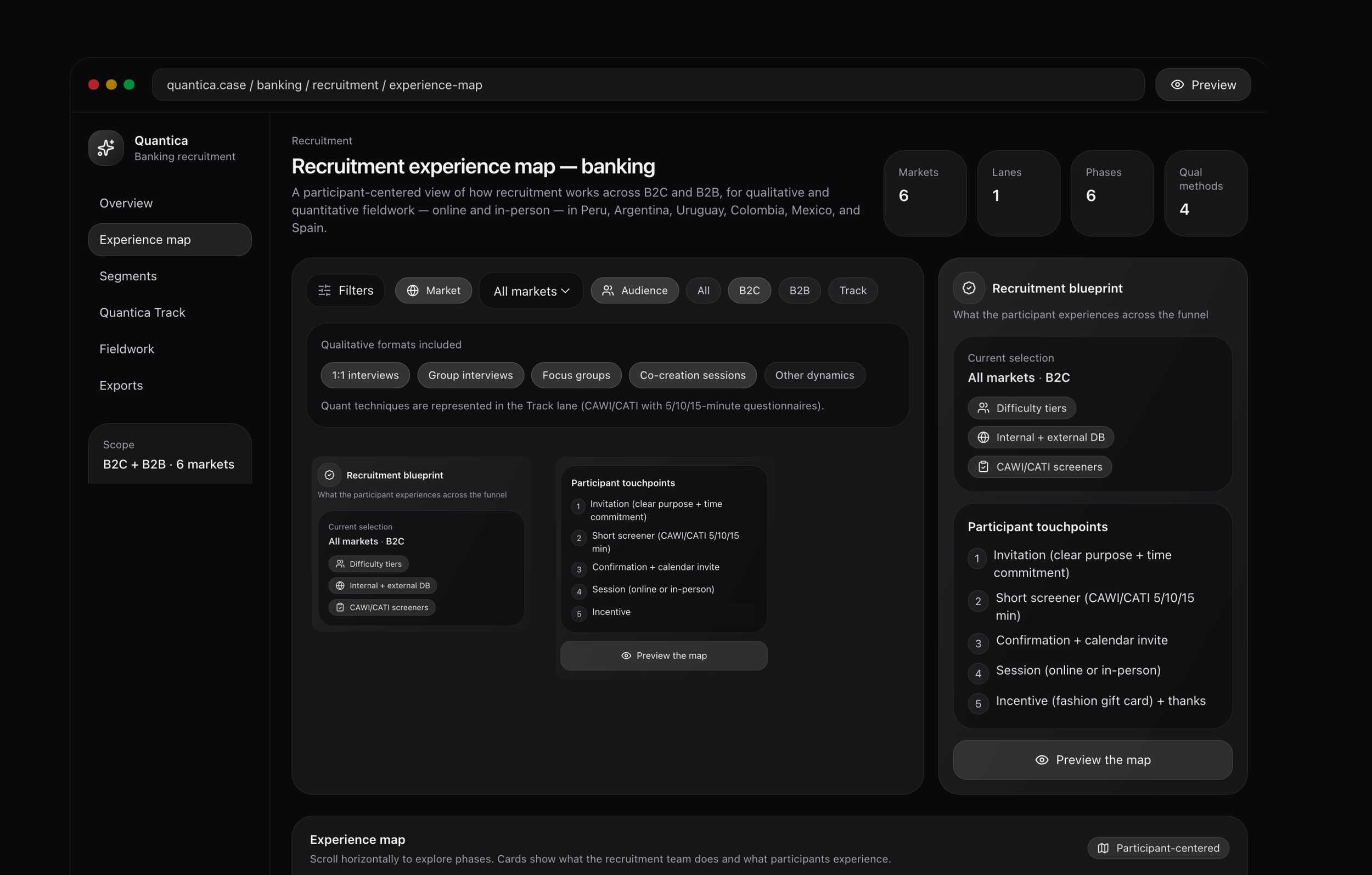

We design the recruitment strategy that supports a qualitative and quantitative banking research programme in six key markets.

Keywords: Banking sector · Spain & LATAM · B2C & B2B · Digital and branch banking · Accessibility · Qualitative recruitment · Quantitative recruitment · CAWI · CATI · International research.

Challenge

The bank, together with its design and research team, wanted to create a flexible and efficient qualitative and quantitative research structure to understand the banking experience of people aged 18–65 in six key markets (Peru, Argentina, Uruguay, Colombia, Mexico and Spain) over several years.

Our role as recruitment partner:

Design a recruitment structure that complies with the bank’s legal and compliance requirements, including the use of internal databases with recorded calls required by the Legal Department.

Ensure solid and comparable samples for B2C and B2B studies in all countries.

Reach profiles with different levels of difficulty: online/mobile banking customers, personal banking, private banking, self-employed professionals, SMEs and large corporations.

Integrate accessibility criteria (very different levels of digitalisation, age and socio-economic context) using both online and telephone channels.

Methodology

We design and execute qualitative and quantitative recruitment tailored to each country, target and difficulty level.

Qualitative recruitment:

Recruitment in the six markets for interviews, group sessions and co-creation workshops (online and in person).

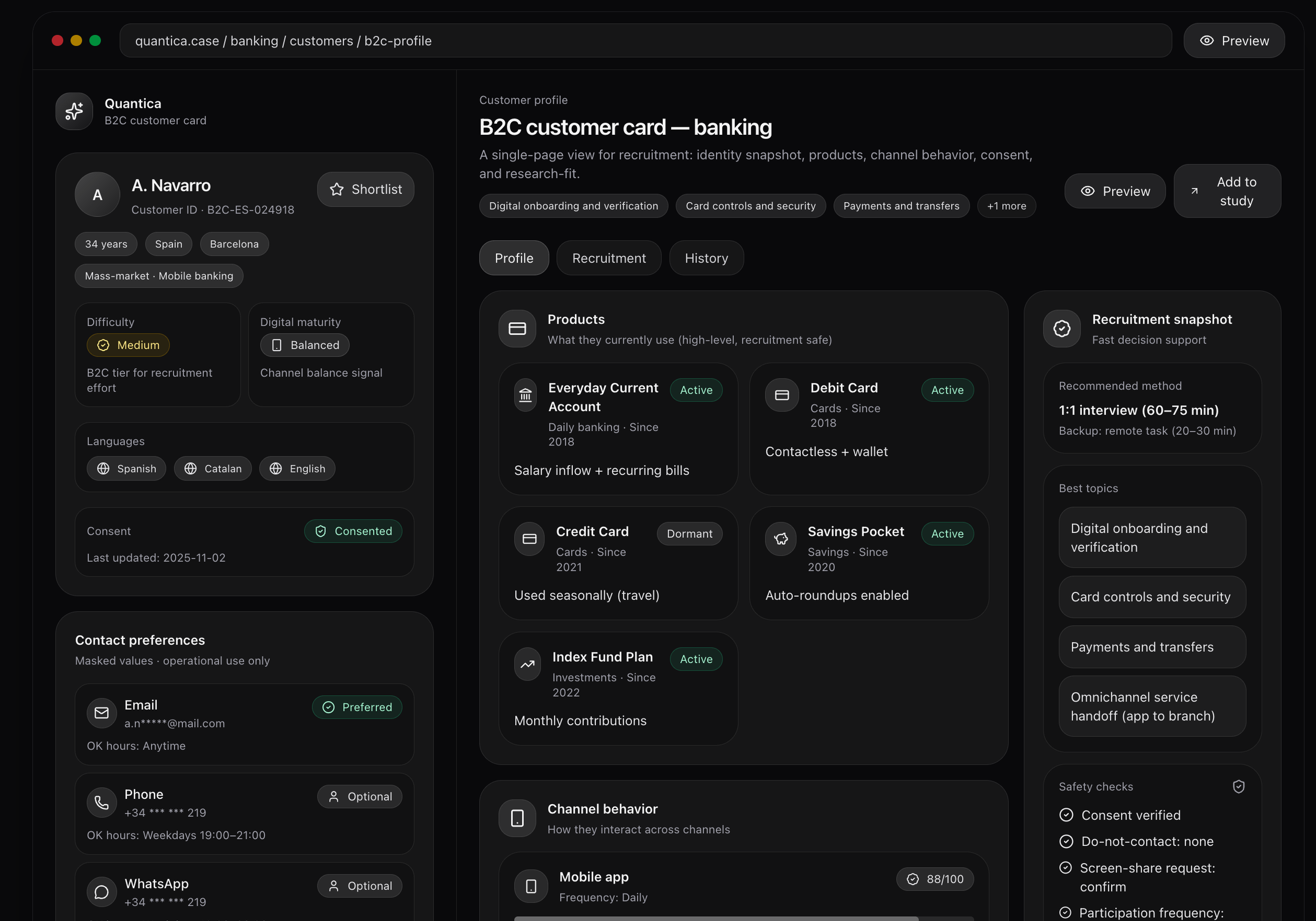

Definition of B2C/B2B difficulty levels (low, medium, high) according to type of client and complexity of access.

Work with the bank’s internal databases and external sources, including recorded calls when required by the Legal Department.

Quantitative recruitment (CAWI & CATI):

Programming and pretesting of online questionnaires (5, 10 and 15 minutes) and telephone scripts.

Fieldwork quality control: logic validation, detection of suspicious responses, interview supervision and status tracking.

Delivery of datasets ready for analysis (Excel/SPSS/CSV) and coding of open-ended questions.

Incentives and legal compliance:

Design of an incentive framework adapted to each country (gift cards, bank transfers, digital wallets).

Processes aligned with the bank’s Legal Department and data protection requirements.

Results

Thanks to this recruitment structure, the bank can:

Roll out complex qualitative and quantitative research programmes in six markets under a single operational framework.

Launch studies faster and with less friction, with clear timelines for programming and recruitment (3–6 days depending on difficulty).

Work with consistent and comparable data across countries, B2C/B2B segments and difficulty levels.

Ensure that incentive management and the use of internal databases comply with regulations, without the internal research teams having to manage that complexity.